Why App stores for banks ?

App store for banks is nowadays becoming very fashionable and trendy. Bundling banks' services through an API is either done by the bank itself (BNY for example) or by fintechs connecting to different banks (Plaid, Open Bank Project, .. just to name a few).

But behind the hype, there are sound reasons for banks to develop in this direction. As banking is not the only industry making this move, there is already a bit of research backing this strategy.

Banks have to face an ever increasing competition from fintechs. In that context, it is interesting to have a look at what has already been researched in the field of organic growth and innovation within large companies.

But behind the hype, there are sound reasons for banks to develop in this direction. As banking is not the only industry making this move, there is already a bit of research backing this strategy.

Banks have to face an ever increasing competition from fintechs. In that context, it is interesting to have a look at what has already been researched in the field of organic growth and innovation within large companies.

Innovation normally occurs in a corporate model for established companies and in an entrepreneurship model for startups. Those two models have a lot of similarities (Engel,2007). In order to more efficiently compete with new entrants, established players are looking at a mix of those two models called: ”corporate entrepreneurship” which is: “the process by which teams within an established company conceive, foster, launch and manage a new business that is distinct from the parent company but leverages the parent’s assets, market position, capabilities or other resources” (Wolcott & Lippitz, 2007).

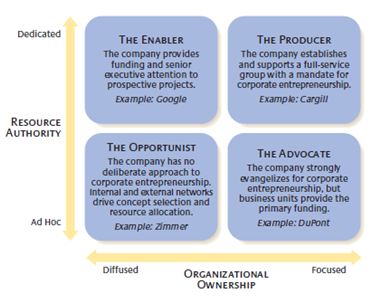

In this research, the authors identify four models to organize corporate entrepreneurship depending on two dimensions: who, within the organization, has ownership of new business creation and who is funding the needed resources:

In this research, the authors identify four models to organize corporate entrepreneurship depending on two dimensions: who, within the organization, has ownership of new business creation and who is funding the needed resources:

|

©Wolcott & Lippitz |

Enabler model

In the “Enabler” model, the company needs to have a strong base of “intrapreneurs“ who are able and willing to build new ideas and products. This needs to be implemented over time having a strong hiring process making sure that employees have a real entrepreneurial spirit.Producer model

The “Producer” model can be set up independently from the existing teams but needs a lot of capital and full binding from top management. It also lacks support from the existing business lines with which the producer department may be felt to compete.

Advocate model

The “Advocate” model is probably easier to set up but requires highly trained individuals able to evangelize the whole company triggering the finding from the business lines.

Uncertainty

But what matters most as shown in this research as well as many others is the ability to face uncertainty: “In the early stages, all innovations are defined by uncertainty. If no uncertainty exists, then an organization is simply not innovating.” (Wolcott & Lippitz, 2007). This clearly connected with the learning process Ries is describing in "Lean startup" and also by Breuer : “If venturing is understood as a learning experience, pacing progress with suitable milestones, and sustaining passion become a constitutive moment in self-directed team learning.”Facing uncertainty is an issue for established players which have been spending a lot of efforts in cutting costs, optimizing their processes to minimize failure and maximize certainty

Referring to the four corporate entrepreneurship models, it may seem easier for institutions to adopt a “Producer” model which is requiring a lot of capital but less diffuse involvement in the company.

But from an absorption capacity view point, this kind of setup tends to be less efficient: “A difficulty may emerge under conditions of rapid and uncertain technical change, however, when this interface function is centralized.” (Cohen & Levinthal, 1990). Centralizing in a group the connection to external knowledge may not give all the possibilities an extended communication throughout the company may provide.

But from an absorption capacity view point, this kind of setup tends to be less efficient: “A difficulty may emerge under conditions of rapid and uncertain technical change, however, when this interface function is centralized.” (Cohen & Levinthal, 1990). Centralizing in a group the connection to external knowledge may not give all the possibilities an extended communication throughout the company may provide.

On top of corporate entrepreneurship, companies can also access new knowledge interacting with startups (Weiblen & Chesbrough, 2015). For this, they need to screen more than before those startups to identify sources of external knowledge. They also need to understand what they can bring to these startups and finally they need to be clear about their expectation from their collaboration with startups.

Research is highlighting four possible models of interactions between large companies and startups:

The first two models involve capital sharing whereas the two others do not. A capitalistic relationship can be an issue for both parties: having a stake of a startup bought by a bank can help bringing resources and customers but it can also limit the startup’s freedom to collaborate with competitors. For the banks, it mobilizes capital and the negotiations are sometimes difficult regarding the price as there are numerous unknowns to valuate properly startups.

Exploring the two last models, the out-in model is pretty unlikely and limited considering the very low R&D efforts within banks.

The Inside-out model is the clear trend those days, where many banks are trying to present an API of their systems in order to develop an eco system on top of their services like Apple and Google did with their smartphone technologies. This approach is also fitting with the "Producer" intrapreneurship model which is quicker to implement for companies like banks that have no innovation culture.

This analysis is supporting the trend seen in many organizations where a dedicated department ("Producer" model) is in charge of building an API and relationships with outsiders in order to build an eco system (Inside-out platform) and increase innovation grabbing knowledge from the startups banks interact with.

Research is highlighting four possible models of interactions between large companies and startups:

- Venture capital, taking a stake in a startup;

- In-out corporate incubation, where the big corporate act as an incubator for its own ideas but not fitting the core business model;

- Out-in corporate incubation where big corporate identify some promising startups which they incubate;

- Inside-out platform where large companies setup a platform with their technology, welcoming startups to contribute in building a full ecosystem (Apple iPhone platform is one example of this approach).

The first two models involve capital sharing whereas the two others do not. A capitalistic relationship can be an issue for both parties: having a stake of a startup bought by a bank can help bringing resources and customers but it can also limit the startup’s freedom to collaborate with competitors. For the banks, it mobilizes capital and the negotiations are sometimes difficult regarding the price as there are numerous unknowns to valuate properly startups.

Exploring the two last models, the out-in model is pretty unlikely and limited considering the very low R&D efforts within banks.

The Inside-out model is the clear trend those days, where many banks are trying to present an API of their systems in order to develop an eco system on top of their services like Apple and Google did with their smartphone technologies. This approach is also fitting with the "Producer" intrapreneurship model which is quicker to implement for companies like banks that have no innovation culture.

This analysis is supporting the trend seen in many organizations where a dedicated department ("Producer" model) is in charge of building an API and relationships with outsiders in order to build an eco system (Inside-out platform) and increase innovation grabbing knowledge from the startups banks interact with.